Malaysia Company Car Tax Deduction

Eligible companies can claim this tax deduction twice up to a maximum amount of RM500000 for each year for up to three consecutive years of assessment starting from the date of implementation approval obtained from TalentCorp. Total taxable BIK income.

Honda Malaysia Drive Home Tax Free In A Brand New Honda Facebook

A company is tax resident in Malaysia for a basis year if.

. Company secretary fee and tax submission fee for Sdn Bhd is eligible for tax deduction up to RM15000. Annual allowance rates vary according to the type of assets and the general rate for. Generally tax deduction is allowed for all outgoings and expenses WHOLLY AND EXCLUSIVELY INCURRED IN THE PRODUCTION OF INCOME.

The deduction for the year of assessment 2017 is restricted to RM4000 as the cumulative deduction is restricted to RM100000 since it is a new non-commercial motor vehicle the cost of which does not exceed RM150000. Additional deduction of MYR 1000 for YA 2020 to. INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text DATE OF PUBLICATION.

A deduction is allowed for cash donations to approved institutions defined made in the basis period for a year of assessment. The annual allowance is given for each year until the capital expenditure has been fully written off. Get the tax answers you need.

RM20100 X 20 RM4020. Tax Exemption on Benefits in Kind Received by an Employee 14 9. For example if you want to reduce company tax payable in Malaysia pioneer status firms can receive up to ten years of tax holidays.

UNDER SECTION 33 ITA 1967. This mechanism is designed to avoid the issues that come with requiring payment of a large sum of income tax when the actual tax amount has been determined. A company is tax resident in Malaysia if its management and control are exercised in Malaysia.

Types of Tax Deductions from. 12 DECEMBER 2019. Applications are for expenses incurred within the period of 1 July 2020 to 31 December 2022.

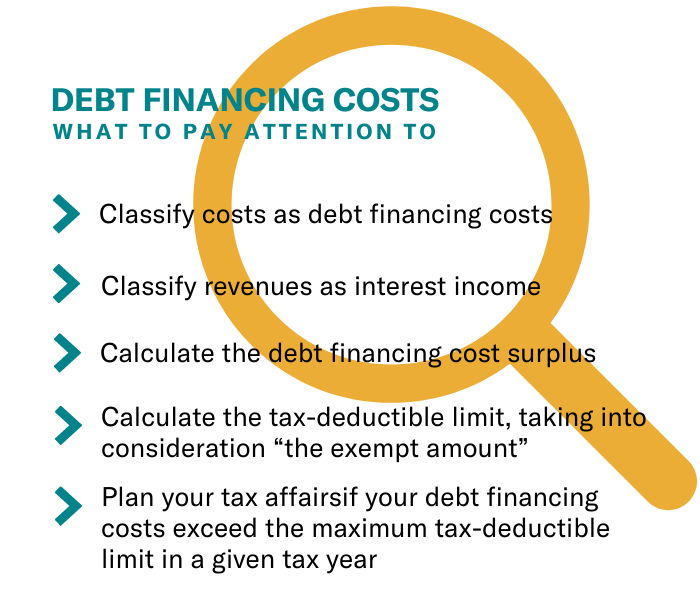

Monthly Tax Deductions MTD also known as Potongan Cukai Bulanan PCB in Malay is a mechanism in which employers deduct monthly tax payments from the employment income of their employees. Deduction Claim 24 13. The deduction is limited to 10 of the aggregate income of that company for a year of assessment.

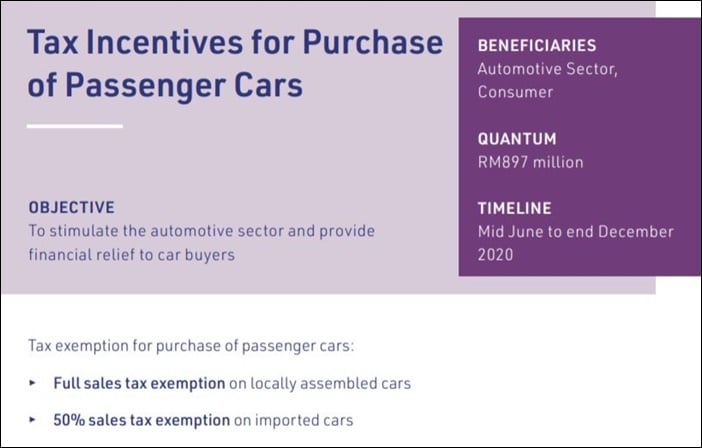

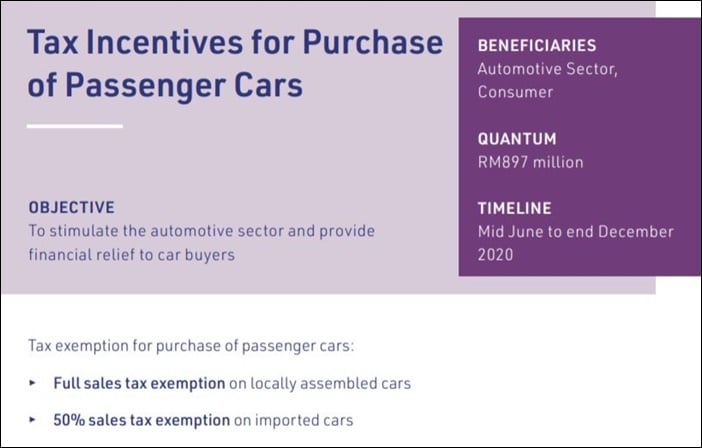

With the country still recovering economically from previous lockdowns an extension of the car sales and service tax SST exemption on all passenger vehicles has been announced during the 2022 National Budget presentation. In the above example it is better to choose the prescribed method as. Fees paid to childcare centre and kindergarten for child ren below six years old.

The first year deduction is 40 of Capital Allowance meaning you can knock off RM40000 from the income sheet if your vehicle qualifies for the RM100k CA followed by 20 the following 3 years until nothing remains. Resident companies are taxed at the rate of 24. Annual allowance is a flat rate given every year based on the original cost of the asset.

Fines and penalties are generally not deductible. For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24. The decision was made to.

The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. For the same reasons no further deductions are allowed for the years of assessment 2018 onwards. We have the experience and knowledge to help you with whatever questions you have.

Purchase of breastfeeding equipment once every two years for women taxpayers only. There is also an investment tax allowance ranging from 60 to 100 as well as reinvestment allowances of up to 60 on your companys capital investment. It is extended for another six months from 1 January to 30 June 2022 for new CKD and CBU cars.

Lease rentals for passenger cars exceeding RM50000 or RM100. Lease rentals for passenger cars exceeding RM50000 or RM100000 per car the latter amount being applicable to. RM12000 X 20 RM2400.

Ad Talk to a 1-800Accountant Small Business Tax expert. Motor vehicle is 20. Management and control are normally considered to be exercised at the place where the directors meetings concerning management and control of the company are held.

Tax Relief for Sdn Bhd Secretary Fee Tax Agent Fee Incorporation Tax Deduction. Updates and Amendments 24 14. 2nd hand vehicle OR priced above RM150000 OR priced below RM100000 Capital Allowance RM50000.

Lets assume the taxpayers tax rate is at 20 the Tax on BIK is. Employers Responsibilities 22 10. Employees Responsibilities 23 11 Monthly Tax Deduction 23 12.

Important Changes To Corporate Income Tax Rodl Partner

Can I Buy A Personal Car Under A Company And Claim Tax Deduction Feb 11 2022 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

Embassy Approved Translation In Malaysia Business Advisor Accounting Services Accounting Software

Sales Tax Exemption On Passenger Cars In Malaysia How Much Will You Save

0 Response to "Malaysia Company Car Tax Deduction"

Post a Comment